Article

R&D Claim Notification Form (CNF)

Article

R&D Claim Notification Form (CNF)

December 10, 2025

8 minute read

Virginia Mariscal-Rios, Corporate Tax Manager, and Will Sweeney, Associate Director for Corporate Tax, at Shaw Gibbs, take a closer look at the form used to notify and initiate R&D claims, while providing essential information.

Authors: Virginia Mariscal-Rios and Will Sweeney

For accounting periods beginning on or after 1 April 2023, companies that wish to claim Research and Development (R&D) tax relief will have to contend with a new requirement in addition to the increasing level of detail required to support their R&D claims.

If this is your first R&D claim, or your company has not made an R&D tax relief claim within the previous three years, you will need to submit a Claim Notification Form (CNF) via HMRC’s online portal within 6 months of the end of your accounting period or you will be unable to make an R&D claim for that period. The notification can be submitted by a representative of the company or an agent acting on behalf of the company (i.e. its corporation tax compliance agent or its specialist R&D tax adviser).

Sounds Straightforward. Why are Companies getting it wrong?

- Well, to start with, the 6-month deadline is much shorter than the previous 2-year deadline for making R&D claims, or even the 12-month deadline for filing your corporation tax return, and so it is easy for smaller companies to miss this deadline without realising it

- Companies may believe that if they have claimed R&D tax relief within 3 years of the last date of their claim notification period, they do not need to send a claim notification form. However, HMRC will not include past claims if:

- The R&D tax relief claim was rejected by HMRC and removed from the company’s tax return

- The company claimed R&D tax relief for an accounting period beginning before 1 April 2023 by amending its tax return and the amendment was received by HMRC on or after 1 April 2023

This means that a Company that has habitually been late in filing its R&D claims may not have an established history of making claims in HMRC’s eyes and so a CNF will be required.

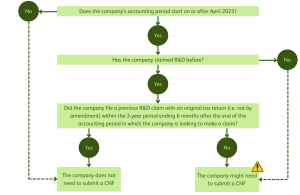

We include below a diagram to help you assess whether your company needs to submit a CNF to notify HMRC of your intention to make a claim for R&D tax relief for the relevant accounting period:

Deadline

The CNF must be submitted at some point between the first day of the accounting period and six months after the end of the relevant accounting period to which the R&D claim relates.

To determine whether you have made an R&D claim within the previous 3 years, this must have been submitted within 3 years of the last day of the claim notification period (six months from the end of the relevant accounting period).

For example, a company which has previously made R&D claims intends to file an R&D claim for the year ended 31 March 2026. The applicable CNF period would run from 1 April 2025 to 30 September 2026. Therefore, the company would need to consider if they made an R&D claim during the three years ending on the last day of the claim notification period, i.e. any claim submitted between 1 October 2023 – 30 September 2026 (R&D claims for periods starting on or before 1 April 2023 that were made by amending the corporation tax return after this date will not count).

For the purposes of this example, let’s consider that the company did not make a claim in the years ended 31 March 2024 or 2025, but submitted an R&D claim by amendment of the original tax return for the year ended 31 March 2023 on 23 May 2024 and then filed an R&D claim with an original tax return for the year ended 31 March 2022 on 30 March 2023 (which is not within the 3-year notification window).

In these circumstances, the company will need to notify HMRC of their intention to make an R&D claim for the year ending 31 March 2026 by 30 September 2026. After this date, if the CNF is not submitted to HMRC, the company cannot make a valid R&D claim. If the company attempts to submit a claim, HMRC will automatically amend the relevant tax return to remove the claim. If the company has a long period of account, only a single notification will need to be submitted to HMRC.

Are there any Exceptions?

To further complicate matters, HMRC’s guidance on this topic did not initially explain that R&D claims made via an amended Company Tax Return, submitted on or after 1 April 2023 for an accounting period beginning before 1 April 2023, would not count as a previous claim. This was only added on 17 October 2024.

As a result, HMRC will allow companies to make an R&D claim where a CNF was required but was not submitted if, and only if:

- A valid R&D claim for an accounting period beginning before 1 April 2023

- The accounting period had a claim notification period ending between 8 September 2024 and 30 November 2024 (i.e. the period ended 8/3/24 – 30/5/24)

- The R&D claim was made in an amended return which was submitted between 1 April 2023 and 30 November 2024.

Contents of the form

The form should contain the following information:

- The company’s Unique Taxpayer Reference (UTR)

- The main senior internal R&D contact in the company who is responsible for the R&D claim, for example a company director

- The contact details of any agent involved in the R&D claim

- The accounting period start and end date for which you’re claiming the tax relief or expenditure credit to match the one shown in your Company Tax Return

- The period of account start and end date

- A high-level summary of the planned R&D activities to confirm that the project(s) qualifies for R&D tax relief as per the standard definition of R&D provided in the DSIT guidelines.

You do not need to include the same level of detail and evidence as for the Additional Information Form required for submission with the actual R&D later – this is simply to confirm to HMRC that you have been carrying out qualifying R&D and intend to make a claim, however there is no obligation to actually submit the R&D claim if circumstances were to change. HMRC guidance on how to submit the claim notification form, is available here.

The reasons why this has been introduced

The CNF has been introduced as a mechanism to give HMRC advanced warning that the company is planning on making an R&D tax relief claim. Some of the reasons behind the introduction of this new requirement are detailed below:

- HMRC are heavily scrutinising R&D tax relief claims at present; recent reports indicate that they are checking as many as 20% of R&D tax relief claims. HMRC’s R&D unit had, in previous years, struggled at times to administer R&D claims due to the number being received at specific times of the year. By introducing the CNF, HMRC will have an increased oversight as to the number of claims which they will need to check and process

- HMRC and the Government believe that R&D relief should be an incentive that drives increased future R&D spend, rather than simply acting as a reward for activity already undertaken. By making it a requirement for new claimants or those who have not made a claim in a long while to pre-notify HMRC of the company’s intention to make a claim, HMRC are effectively reducing the timeframe that a company can look back and amend their self-assessment returns to make a claim for past R&D undertaken. In an ideal world, HMRC hopes to get to a point where companies considering potential R&D will document whether they qualify for R&D relief from the outset, reducing the potential for fraudulent or unscrupulous claims down the line.

Whilst we understand and support the reasons behind this new requirement, there is a concern that companies who are undertaking genuine qualifying R&D, and have accounted for the relief they are entitled to in their cash flow plans could now miss out on making claims if they fail to give notice to HMRC before the end of the claim notification period.

For more information or advice on complying with this new requirement or if you would like support on R&D tax relief in general please contact Virginia Mariscal Rios or your usual Shaw Gibbs contact.

Related content

Need expert advice?

Speak to an expert for advice on

+44-1865 292200 or get in touch online to find out how Shaw Gibbs can help you

Email

info@shawgibbs.com

Need expert advice?

Speak to an expert for advice on

+44-1865 292200 or get in touch online to find out how Shaw Gibbs can help you

Email

info@shawgibbs.com